Doing B2B account scoring the right way: models, strategies & examples

Learn how Demandbase does B2B account scoring the right way. Discover models, strategies, and examples to prioritize high-value accounts and boost revenue.

What is account scoring?

Account scoring is the data-driven approach used by B2B revenue teams to evaluate, rank, and prioritize target accounts based on their likelihood to become high-value customers.

It’s a ‘quantifiable’ way of filtering thousands of possible accounts into a prioritized, actionable list that sales can engage.

A simple way of thinking about it is using your credit score — but applied to entire companies. A high credit score tells a lender that you’re financially reliable. In the same way, a high account score tells sales and marketing that a company is a strong potential customer.

It’s a single, clear indicator of an account’s overall “health” and buying potential, that guides GTM teams on where to focus time, budget, and resources.

Related → Understanding AI Lead Scoring: Definition, Benefits, and How to Get Started

Why is account scoring important?

Because it exists to answer a common question most GTM teams have:

“Of all the accounts we could pursue, which ones should we pursue right now, and why?”

You see, not every account is created equal, and not every account is equally ready to buy.

- Some may fit your ideal customer profile (ICP) perfectly but show no interest in buying.

- Others may be actively researching but fall far outside your ICP.

- And many are simply “noise”, i.e., accounts that look busy but have little chance of converting into revenue.

Without a systematic approach of knowing ‘who, when and how’, sales efforts will be wasted chasing the wrong prospects, while marketing overspends on underperforming campaigns.

Account scoring simplifies this complexity by combining three data inputs into one unified model:

Account fit: How closely the account matches your ICP. This includes firmographic and technographic data such as industry, company size, revenue, growth rate, and technology stack.

- For example, if your product is designed for mid-market SaaS companies with 200-500 employees, accounts that fit this profile will receive a higher score than enterprise manufacturers with 10,000+ employees.

Intent data: Whether the account is actively in-market for solutions like yours. This comes from third-party sources (searches, content consumption across the web, publisher data) and first-party signals (visits to your website, downloads, or form fills).

- For example, if a healthcare SaaS company that matches your ICP is suddenly spiking in searches around “customer data platforms,” that’s a clear buying signal.

Engagement data: How the buying committee at the account interacts directly with your brand. This includes ad clicks, webinar attendance, event participation, email opens, or direct conversations with your sales team.

- If three decision-makers from the same account recently attended your product demo, that engagement significantly boosts their score.

When you put these three signals together, you get a score that can help you easily identify who to talk to, when, and how.

Let’s get practical:

Say your ICP is mid-sized fintech firms with 100-500 employees. You’ve identified two accounts:

Account A: A 250-employee fintech startup using several complementary technologies in your ecosystem.

- They’ve recently downloaded your whitepaper on fraud detection and have been actively searching for “real-time risk scoring software.” Three people from the account also registered for your recent webinar.

Account B: A large enterprise bank with 5,000 employees. They don’t match your ICP well and show no recent signs of intent or engagement.

Without scoring, your reps might chase the enterprise account just because of its name recognition and perceived value.

Meanwhile, with account scoring, Account A clearly emerges as the higher-priority opportunity. It fits your ICP, shows strong intent, and is actively engaging with your brand.

The score reflects this alignment, allowing your team to prioritize where the odds of conversion are highest.

The ICP factor: Foundation of account scoring

Your account scoring system can’t be effective if you don’t first ‘nail’ your ICP.

Your ICP defines the ‘fit’ pillar of account scoring, ie.., the baseline criteria that determine whether an account is even worth pursuing in the first place. Without this anchor, intent and engagement signals lose context.

For example, a small startup might show a flurry of interest in your enterprise solution, but if they don’t meet your ICP in terms of size, budget, or infrastructure, that signal is merely a distraction.

Nailing your ICP ensures that every other scoring criteria sits on solid ground. It gives your teams clarity on who your best-fit customers are, why they matter, and what attributes should weigh most heavily in the scoring process.

This alignment prevents wasted marketing efforts, reduces friction between marketing and sales, and sharpens your go-to-market strategy.

Account scoring vs. lead scoring: The critical shift

For years, B2B teams built their funnels around lead scoring. Marketing tracked individual actions and assigned points to decide when a prospect became an MQL (marketing qualified lead).

This looked like a big step forward from the days of cold-calling prospects based on ‘instincts’. But even lead scoring is not applicable anymore because B2B buyers have changed their purchasing behavior.

Now, the average deal involves an entire buying committee, often six to ten stakeholders across IT, finance, procurement, etc.

Focusing on one lead in isolation is not a sustainable strategy. It in fact blinds revenue teams to the broader dynamics of an account, and in many cases, causes them to miss the signals from key accounts.

The limits of lead scoring

Lead scoring operates at the individual level. A person earns points based on their attributes (e.g., job title, seniority, industry) and their behaviors (e.g., opening a nurture email, visiting a pricing page, attending a webinar). Once they cross a threshold, marketing hands them over to sales as “hot.”

On the surface, this makes sense. But here’s the problem:

- A junior analyst from a poor-fit company who ‘binge-downloads’ whitepapers can easily be flagged as sales-ready.

- Meanwhile, subtle but high-value activity—like three senior leaders from a perfect-fit company quietly researching your category—might go completely unnoticed because no single individual crossed the scoring threshold.

This blind spot means sales teams spend time chasing individuals with no buying power, while truly promising accounts slip away before they’re even noticed.

Account scoring gives the advantage

Account scoring moves the approach from the individual to the account level. First, it aggregates all signals (fit, intent, and engagement) across the entire organization. Then it evaluates how well those signals align with your ICP.

This shift does three critical things:

- Reveals the true buying committee. By looking at the sum of activity across an account, you can identify the multiple voices that will influence a purchase.

- Captures early-stage interest. Even if no single individual looks “hot,” account scoring surfaces accounts where the collective behavior indicates growing intent.

- Prioritizes high-value accounts. It ensures your sales team doesn’t waste time on individuals from poor-fit companies while missing opportunities at the accounts that actually matter.

| Lead Scoring | Account Scoring | |

|---|---|---|

| Level of focus | Individual person (a single contact). | Entire account (the full buying committee). |

| Data inputs | Demographics (job title, role, industry) + individual behaviors (email opens, webinar attendance, downloads). | Fit (ICP alignment), intent (external research), and engagement (multi-contact activities across the account). |

| Primary goal | Identify and pass a "hot lead" to sales. | Prioritize accounts with the highest likelihood to convert and deliver revenue. |

| Blind spots | Overvalues single actions and ignores broader account activity. | Surfaces aggregate intent + engagement, reducing false positives and missed signals. |

| Pipeline quality | Risk of sending sales low-value or unqualified leads. | Delivers fewer but higher-value accounts that align with ICP and show real purchase intent. |

| Strategic impact | Reactive: responds to isolated signals. | Proactive: aligns GTM motions around where revenue potential actually exists. |

| Best Fit For | Legacy, lead-driven funnels with smaller deals. | Modern, account-based strategies with complex B2B sales cycles. |

The anatomy of a modern account scoring model in B2B SaaS

Account fit: Do they belong in your market?

Account fit measures how closely a company aligns with your ICP. It’s the most foundational layer of account scoring because if an account doesn’t fit your market, no amount of intent or engagement signals can make it a good opportunity.

Fit scoring typically evaluates firmographic and technographic attributes, including:

- Industry: Does the company operate in a sector where your solution has proven success?

- Size and revenue: Does the account’s scale align with your target (e.g., SMB, mid-market, or enterprise)?

- Geography: Does the company operate in regions where you can sell and support effectively?

- Tech stack: Does the account use complementary technologies that indicate readiness for your product?

These attributes are given weights based on historical win data. If your past customers show a strong correlation between account size and deal size, employee headcount might carry more weight in the fit score.

Example: If you sell enterprise cybersecurity software, a 50-person retail shop may generate some website clicks (engagement) or read a blog about phishing (intent), but they don’t fit your ICP.

Now compare that with a Fortune 500 healthcare provider with a large IT team already running complementary security tools—that’s a strong account fit.

Intent scoring: Are they in the market right now?

Intent scoring evaluates whether an account is actively in-market for solutions like yours by analyzing behavioral data from across the web.

It tracks research activity to surface signals that the buying committee is preparing to make a purchase.

There are two major sources of intent data:

- First-party intent: Behavior captured on your own channels (visiting pricing pages, attending webinars, downloading case studies).

- Third-party intent: Behavior captured outside your ecosystem, such as surging interest on publisher networks, review sites, or industry forums.

The aim here is to identify where accounts are in their buying journey and whether they’re worth prioritizing now.

Example: Let’s say multiple employees from a mid-sized financial services firm are suddenly downloading reports on “AI-driven fraud detection” across third-party sites.

Even if your sales team hasn’t engaged them yet, intent data surfaces this account as actively exploring solutions like yours.

Account engagement: Are they interacting with you?

Account engagement measures how an account’s buying committee is interacting directly with your brand. It captures all first-party interactions, from website visits and email opens to webinar attendance, sales calls, and product trials.

This scoring provides a real-time view of how interested and invested an account is in your solution. Unlike intent (which signals interest), engagement reflects how much the account is leaning into your brand specifically.

Account engagement can also track depth of interaction:

- Passive engagement: Opening an email or reading a blog.

- Active engagement: Attending a live demo, interacting with a pricing calculator, or requesting a proposal.

These signals can then be weighted accordingly for the next course of action.

Example: If five different people from a large SaaS company attend your webinar, one downloads your technical whitepaper, and another interacts with your SDR on LinkedIn.

All indicators show that they are interested in the topic — and more specifically, engaging with your brand doing that.

How to do B2B account scoring in four easy steps

Step 1: Solidify your ICP

This is the absolute, non-negotiable starting point. As we discussed earlier, account scoring is built on the foundation of fit, and your ICP is the blueprint for what “fit” looks like in your business.

Here’s how to build and solidify your ICP:

Analyze historical success: Look at your best existing customers—those with the highest revenue, shortest sales cycles, and longest retention. Identify what they have in common.

Gather firmographic and technographic data: Consider industry, company size, annual revenue, geographic location, and the technology stack they rely on.

- For example, a SaaS vendor may find their sweet spot is mid-market tech companies with 500-5,000 employees, headquartered in North America, already using Salesforce and Slack.

Factor in negative traits: Just as important as knowing your best-fit customers is knowing who is not a fit.

- For example, companies under 50 employees or those in industries with limited budgets may not justify resource allocation.

Get alignment across GTM teams: Marketing, sales, and customer success must be in the same room to define and commit to a single, documented ICP. Disagreement at this stage leads to misaligned scoring later.

You can use the checklist below as a way to evaluate your ICP:

The ICP litmus test for account scoring

Fit check

- Does the account match your must-have firmographics (industry, size, revenue, geography)?

- Do they use the right technographics (tools, platforms, level of maturity)?

If “yes,” pass. If “no,” stop. The score doesn’t matter.

Pain point alignment

- Are the account’s challenges aligned with the exact problems your solution solves best?

- Can you tie at least one critical pain point directly to your value proposition?

If you can’t, then they’re a low-value fit (even if their score ‘looks’ high).

Buying dynamics

- Do you know who the key stakeholders are in this type of account?

- Are you clear on the decision-making structure (centralized, committee, executive-led)?

If the path to purchase is unclear, the scoring model might represent some key indicators.

Proof of success

- Do you already have lookalike customers with high LTV from this ICP segment?

- Can you point to real case studies, testimonials, or data proving success?

If you can’t, there’s a low chance the account will convert.

Relevance over time

- Has your ICP been refreshed in the last 6-12 months?

- Does it reflect shifts in market trends, customer budgets, and buying behavior?

If the ICP is outdated— so is the scoring model, irrespective of how ‘advanced’ it looks.

DB Nuggets → If your ICP is “regulated financial services companies with 1,000+ employees using AWS,” then a 10-person design agency—no matter how active—should never top your account scoring list.

Step 2: Define and weight your scoring attributes

Once your ICP is locked in, the next step is to turn it into scoring attributes. These are the actual data points you’ll track and measure to generate an account score.

The goal is to identify which signals are most predictive of purchase for your business and then assign the right weight to each.

Here’s how to do it:

Fit attributes: These reflect how closely an account matches your ICP.

Examples:

- Industry = fintech (20 points)

- Company size > 500 employees (15 points)

- Uses salesforce CRM (10 points)

Intent attributes: These measure research behavior outside your owned channels. Examples:

- Researching “GTM platforms” (15 points)

- Searching competitor names (20 points)

- Downloading content from industry analyst sites (10 points)

Engagement attributes: These track direct activity with your brand. Examples:

- Pricing page visit (30 points)

- Attended a product demo webinar (25 points)

- C-level executive downloaded a case study (20 points)

- Junior employee opened an email (5 points)

DB Nuggets → If you simply gave 10 points to every interaction, an intern opening 10 emails would outscore a VP requesting one demo. That’s the kind of distortion weighting prevents.

Related → The Most Powerful Account Identification in ABM? Demandbase Just Built It

Step 3: Establish actionable scoring thresholds

A score of “78” means nothing if no one knows what to do with it. That’s why the next step is to create scoring thresholds tied to clear, predefined actions.

This ensures the sales and marketing team always know how to respond when an account crosses a certain threshold.

A typical tiered model might look like this:

Tier A (MQA): Score 85+

High-value accounts that are a strong fit, showing active intent, and engaging with your brand.

- Action: Route immediately to the appropriate sales rep for personalized, high-priority outreach within 24 hours.

Tier B (warm accounts): Score 60–84

Good-fit accounts showing some early buying signals, but not fully in-market yet.

- Action: Enroll them in targeted account-based marketing campaigns, retargeting ads, and nurture sequences designed to accelerate engagement.

Tier C (monitor accounts): Score < 59

Potential accounts with good fit but little to no current buying intent.

- Action: Keep them in low-cost, broad-reach marketing channels (social media, newsletters). Monitor for spikes in intent or engagement that could lift them into higher tiers.

For example, a 1,500-employee healthcare company visiting your pricing page and showing a competitor intent spike hits Tier A instantly.

Meanwhile, a similar-size healthcare company that only downloaded a top-of-funnel eBook might sit in Tier B until stronger signals appear.

DB Nuggets → Don’t overload reps with Tier B or C accounts. Keep thresholds meaningful so sales knows Tier A always deserves immediate focus.

Step 4: Automate the process

Account scoring is a real-time system that needs to update as signals change. Manually tracking thousands of accounts and millions of signals is impossible. You need to automate the entire process, and integrate it across your GTM systems.

Automation ensures:

- Scores are always up to date as new data streams in.

- Sales reps see real-time prioritization in their CRM without manually refreshing spreadsheets.

- Marketing can dynamically adjust campaigns (e.g., shifting a Tier B account to Tier A retargeting as soon as their intent spikes).

DB Nuggets → When you automate, you prevent your GTM teams from ‘cherry-picking’ accounts based on personal bias because the system delivers objective priorities using real data.

Related → The Undeniable Impact of Account Tiering for a Modern ABM Strategy

Thinking of switching to Demandbase?

Most teams (probably like yours) have the same problem Baker Tilly had. And that is an outdated (spreadsheet) process of managing client and prospect data.

According to Jamie Flores, Director of CRM, Baker Tilly:

“The system was good enough. But the data wasn’t. That was the tripping point. Without accurate information, even the best CRM is just shelfware.”

Why should you make the switch?

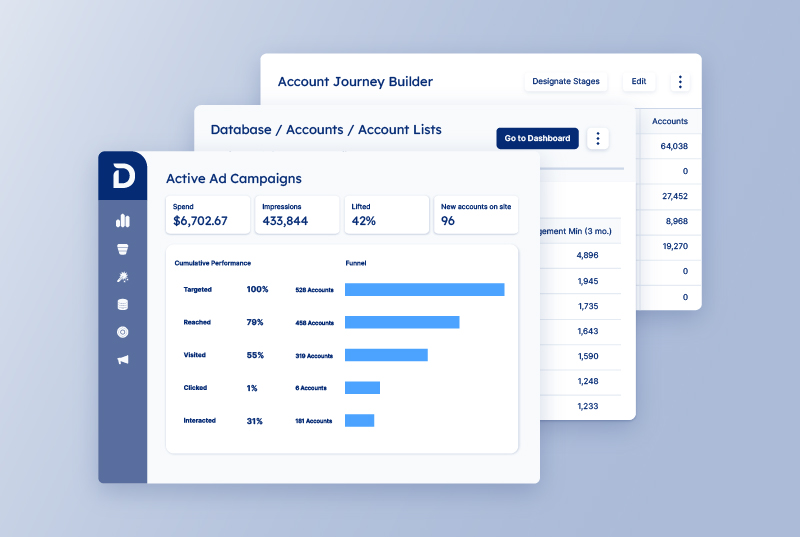

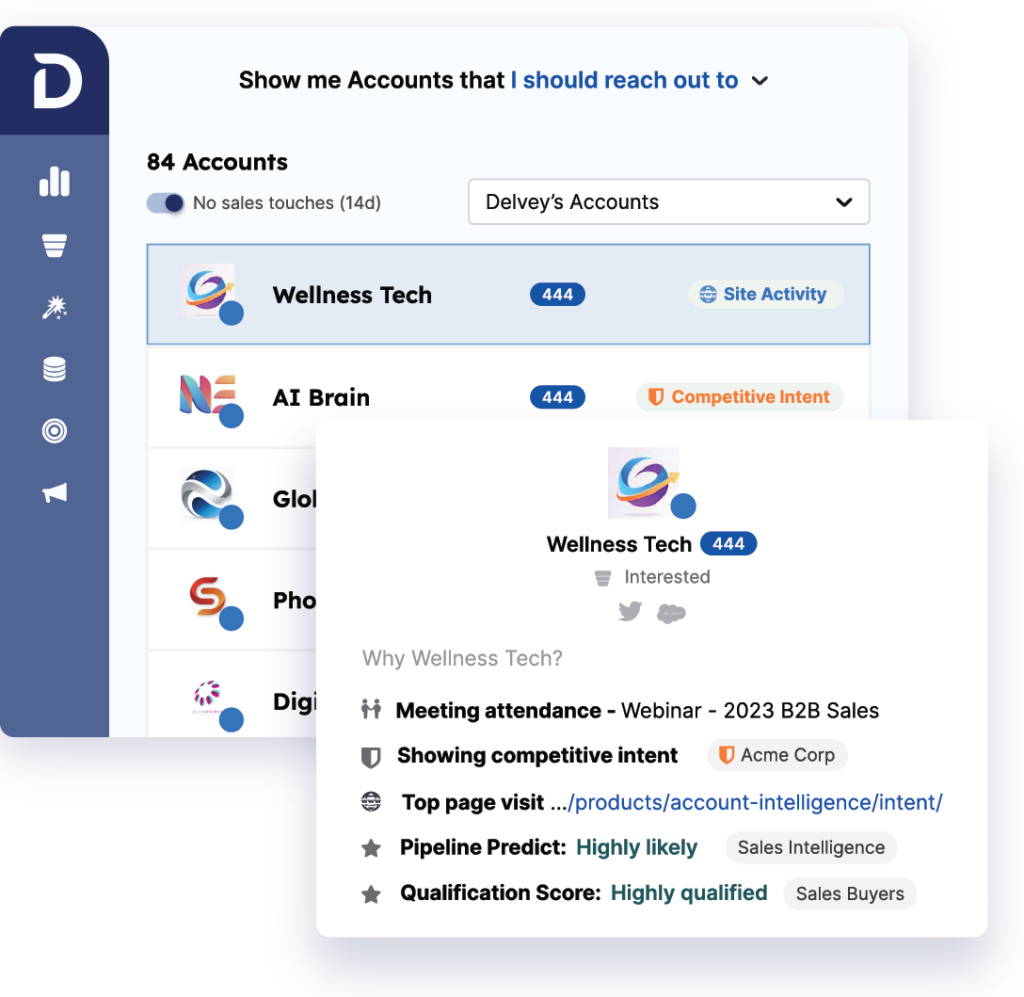

Because Demandbase unifies fit, intent, and engagement into a single dynamic score.

This combination ensures your scoring model reflects both long-term potential and near-term readiness to buy. Plus, sales always has the freshest view of which accounts are heating up.

And again, Jamie confirms this—

“While we don’t directly track ROI, it’s clear that the salespeople who do the most research with Demandbase also have the highest closed/won rates. That’s not a coincidence.”

Let the right accounts find you.

7 Best practices for a successful account scoring implementation

Secure cross-functional alignment early

Account scoring will fail if it’s seen as a ‘marketing-only’ exercise. For it to succeed, you need early buy-in from every team that touches revenue: sales, SDRs, RevOps, marketing, and leadership.

That means discussing what signals matter most, how they should be weighted, and what thresholds define a marketing qualified account (MQA).

For example: Sales should understand how scores reflect real buyer activity; marketing should know how scores guide campaign design; and RevOps should own the system that ties it all together.

This alignment avoids the all-too-common scenario where marketing swears by the score while sales dismisses it as irrelevant.

Balance fit, intent, and engagement

A good scoring model is not one-dimensional.

- If you lean too heavily on fit, you end up with a list of ‘dream’ accounts that may not be in-market.

- If you rely only on intent, you’ll chase accounts that are actively researching but may be a terrible match for your solution.

- And if you focus solely on engagement, you risk mistaking curiosity for buying readiness.

The best approach is balancing all three in a way that shows you the right active accounts to engage.

Related → How to Identify Accounts for ABM: A Step-By-Step Guide for B2B Marketing Teams

Connect scoring to GTM workflows

To make your scoring model actionable, integrate it directly into your GTM stack.

The scores should flow automatically into your CRM, MAP, and sales engagement tools. This allows for real-time routing, campaign enrollment, and sales alerts.

For example, if an account moves from Tier B to Tier A, your system should immediately notify the assigned rep, trigger an ABM ad campaign, and include the account in your weekly pipeline review. Scoring will only help you drive revenue when it is operationalized into daily workflows.

Keep data clean and reliable

Your account scoring foundation needs to be built on reliable data. If your CRM is full of duplicates, outdated contacts, or inaccurate firmographics, your model will fail. Similarly, low-quality intent feeds can swamp your system with noise.

To avoid this, regularly audit your data sources, validate your integrations, and make sure your systems are pulling in accurate, relevant, and current information.

Keep it simple

It’s tempting to overcomplicate account scoring with dozens of variables, but complexity often makes adoption difficult. And when sales reps can’t understand why an account is scored a certain way, they stop trusting it.

Start with simplicity: 3 to 5 attributes for each pillar (fit, intent, engagement), and build gradually.

The goal is to make the model both predictive and user-friendly. A rep should be able to look at a score and immediately grasp why it’s high or low.

Train and enable your teams on the system

An extension of keeping it simple is ensuring your team knows how to use the scoring model you’ve implemented.

For this, run enablement sessions for sales and marketing to explain how scores are calculated, what thresholds mean, and what actions should follow.

For example, sales should understand why Tier A accounts require immediate personalized outreach, while customer success should recognize which signals represent upsell opportunities versus churn risks.

Also encourage feedback from frontline reps so the model feels collaborative rather than imposed. When your teams understand and trust the system, they can act on it consistently.

Test and validate your model regularly

No account scoring model is perfect out of the gate. The danger is assuming it’s ‘static’ when, instead, it should evolve with your market, ICP, and buyer behavior.

One way to fix this is by building testing into your process. After 90 days, analyze whether Tier A accounts are indeed converting at higher rates than Tier B or Tier C.

Also check if the attributes you weighted heavily are actually predictive in practice. Based on the data collected, you can use pipeline and closed-won data to validate and recalibrate the model.

How to track the effectiveness of account scoring

To secure adoption and justify ongoing investment, you need to track how account scoring influences pipeline, deal velocity, win rates, and sales team behavior.

The guiding principle is simple: compare the business results from your high-scoring accounts against those from lower-scoring accounts.

If the model is working, you should see a clear performance gap that proves it is correctly identifying the accounts most likely to generate revenue.

Below are the most important metrics to monitor.

Win rate by score tier

This is the clearest indicator of success. If your scoring is effective, Tier A accounts should close at much higher rates than Tier B or C.

For example, if your overall win rate is 20%, but accounts in Tier A close at 40%, you have proof that your scoring model is surfacing the right opportunities.

To measure this: break your closed-won and closed-lost deals into their scoring tiers at the time of opportunity creation. Then track the percentage of wins in each tier over time.

- Large gaps between tiers validate the accuracy of your model, while little to no difference suggests your signals or weights may need recalibration.

Sales cycle length

The length of the sales cycle is a direct reflection of whether your sales team is engaging accounts that are ready to buy.

High-scoring accounts: those with strong fit, clear intent, and active engagement— should move faster through the funnel because they’re already ‘primed’ for a decision.

Track the average number of days from opportunity creation to close, segmented by score tier.

- If your Tier A accounts close 20-30% faster than Tier B, you know the model is shaving wasted time off your pipeline.

- If the gap is negligible, it may mean your signals are too focused on fit and not enough on in-market intent.

Average contract value (ACV)

Because fit is one of the pillars of account scoring, your highest-scoring accounts should also represent larger, more strategic deals.

Tracking ACV by tier validates whether your ICP definition and fit attributes are correctly aligned with high-value outcomes.

- Tier A accounts should deliver meaningfully higher ACV than lower tiers.

- If Tier C accounts are consistently producing higher ACVs, it’s a signal your ICP (and therefore fit scoring) needs recalibration.

MQA-to-opportunity conversion rate

This is a leading indicator of alignment between marketing and sales. It measures the percentage of high-scoring MQAs that sales accepts and converts into opportunities.

- A healthy benchmark is 60-80%. If MQAs are consistently converting at that rate, it shows your model is surfacing accounts sales agrees are worth pursuing.

- If conversion rates are much lower, it means marketing is passing too many false positives—or sales isn’t adopting the scoring model.

Sales team adoption

A scoring model is useless if it’s not acted upon. You need to monitor whether your sales team is engaging with accounts once they become high-priority.

- The simplest way is to track the number of sales activities (calls, emails, meetings) logged against accounts within 24-48 hours of being flagged as Tier A MQAs.

If adoption is low, it may indicate that sales reps don’t trust the scores or can’t easily see them in their workflow (e.g., buried in a separate dashboard instead of CRM).

Fixing this requires enablement, transparency (showing sales why accounts scored high), and alignment on playbooks.

Pipeline contribution by tier

Beyond conversion rates, you want to measure how much of your overall pipeline is being generated by high-scoring accounts.

- If your Tier A and Tier B accounts account for 70-80% of pipeline creation, it proves that scoring is steering your GTM motion in the right direction.

- If pipeline is being created equally across all tiers, the model isn’t providing enough differentiation.

Recommended case study → How League increased meeting bookings by 41% using Demandbase

Account Scoring FAQs

What’s the difference between account scoring and lead scoring?

Lead scoring evaluates individual contacts. Account scoring aggregates signals across people, intent, and engagement to reflect true buying readiness.

What data should be included in account scoring?

Effective models combine firmographics, technographics, intent data, and account-level engagement.

How often should account scoring models be updated?

At minimum, quarterly. High-growth teams refine models continuously based on pipeline and revenue performance.

Who should use account scoring?

Account scoring is essential for B2B marketing, sales, and RevOps teams focused on prioritization and alignment.

What’s the biggest mistake teams make?

Overweighting engagement without accounting for ICP fit or buying intent.

The Demandbase way: From manual scoring to AI-powered intelligence

If you’ve ever tried to run account scoring from a spreadsheet, you know how quickly it falls apart. Numbers get stale, bias creeps in, and before long sales and marketing are arguing over which accounts to prioritize instead of closing deals.

With (us) Demandbase, it’s different— the scoring lives in your system.

We start by unifying fit, intent (from our proprietary network), and engagement data into one view so you finally have a complete picture of every account.

Then our AI and machine learning models go to work, analyzing your historical deals, surfacing the patterns behind your highest-value wins, and automatically weighting the attributes that matter most.

What you get is a scoring logic that adapts to your business and evolves with your pipeline no matter how the market shifts.

Related →How AVEVA elevated account-based marketing with Demandbase

“[Demandbase] has been helping us reduce the amount of admin. Before, it was stitching together reports, trying to build that together in excel spreadsheets…downloading, uploading various things… Now it’s connected to Marketo in Salesforce [...] makes our life a whole lot easier. You know we can aggregate that data and provide it to the sales people straight away without having to do much manual intervention.”

Global Account Based Marketing Director, AVEVA

Your next big deal is already in the data.

Related content

We have updated our Privacy Notice. Please click here for details.